PC Construction Industry Analysis

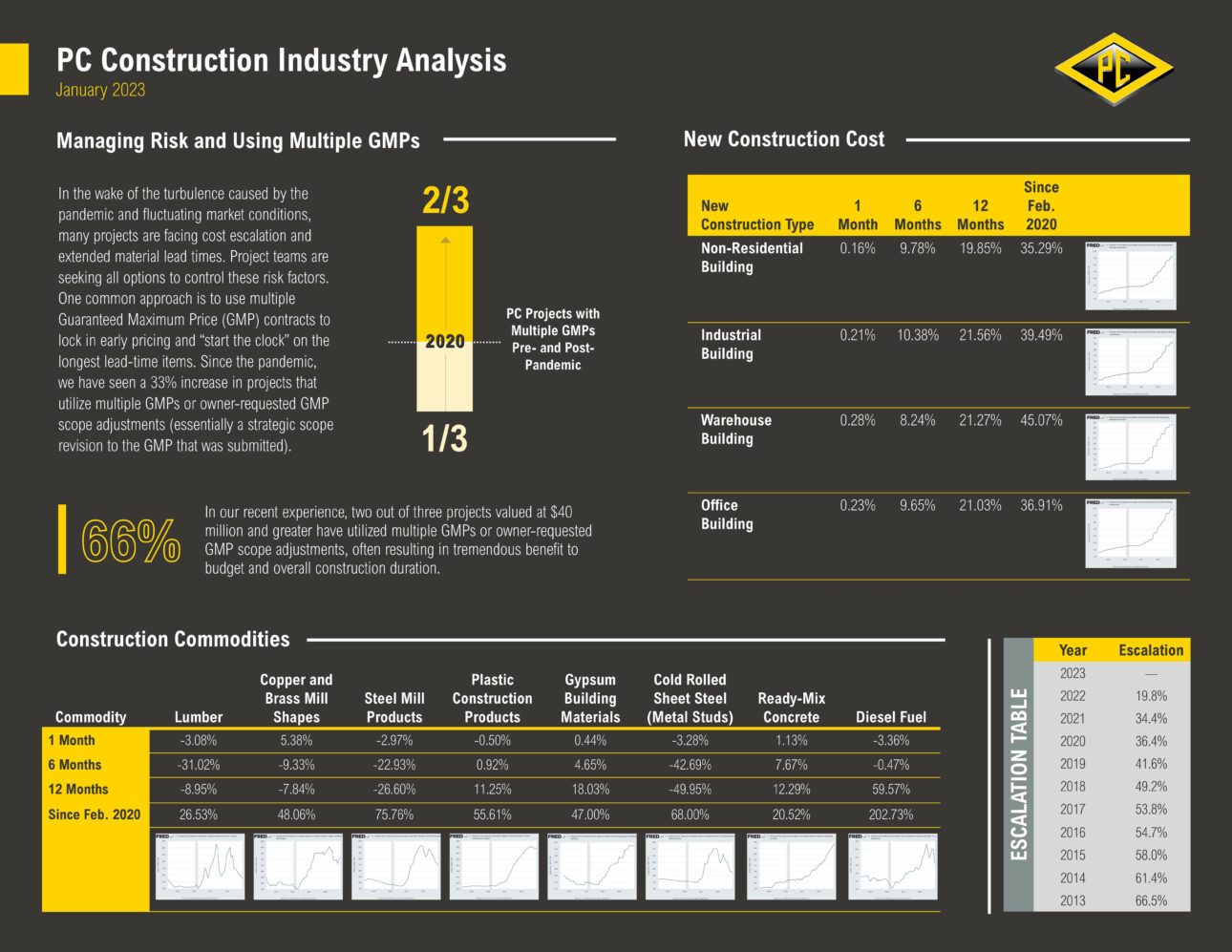

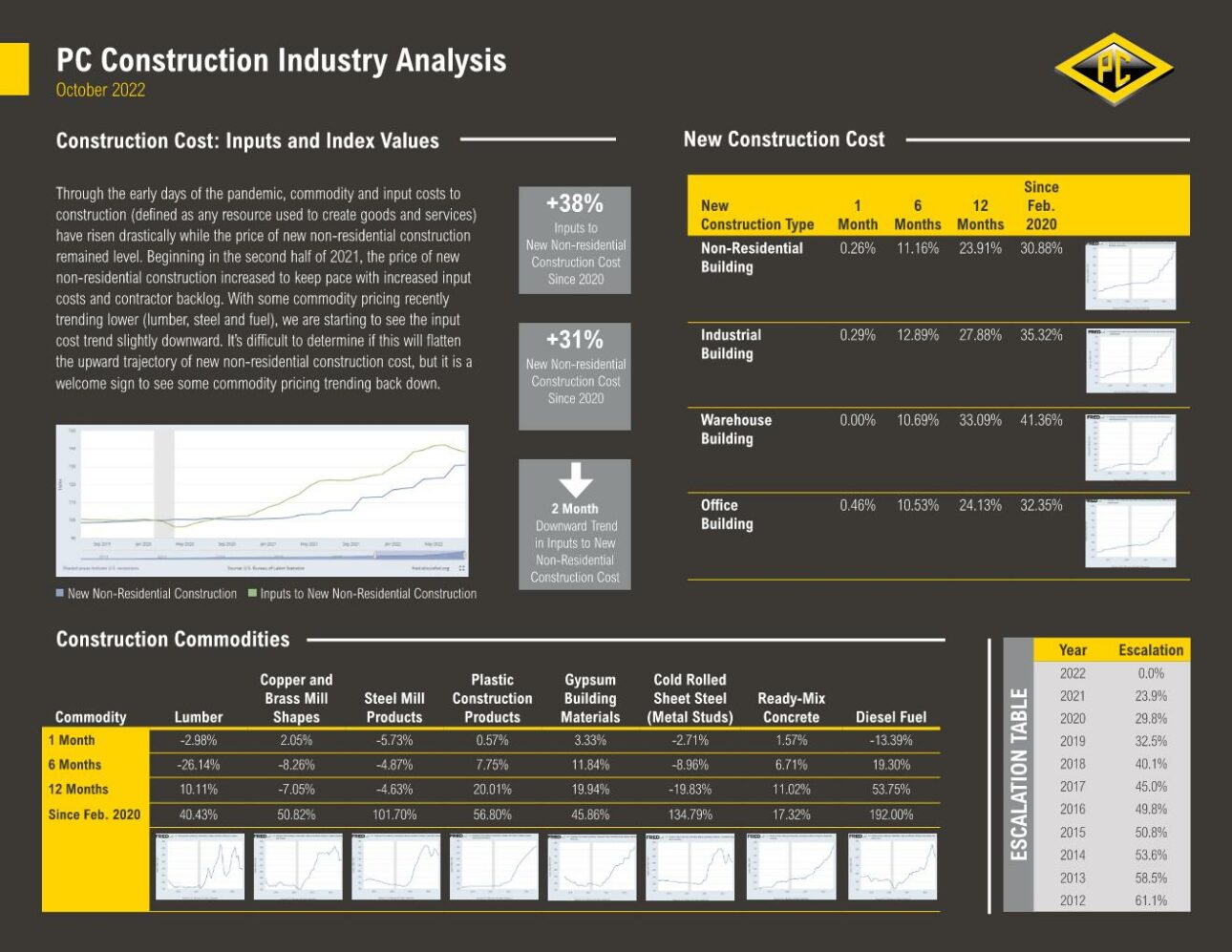

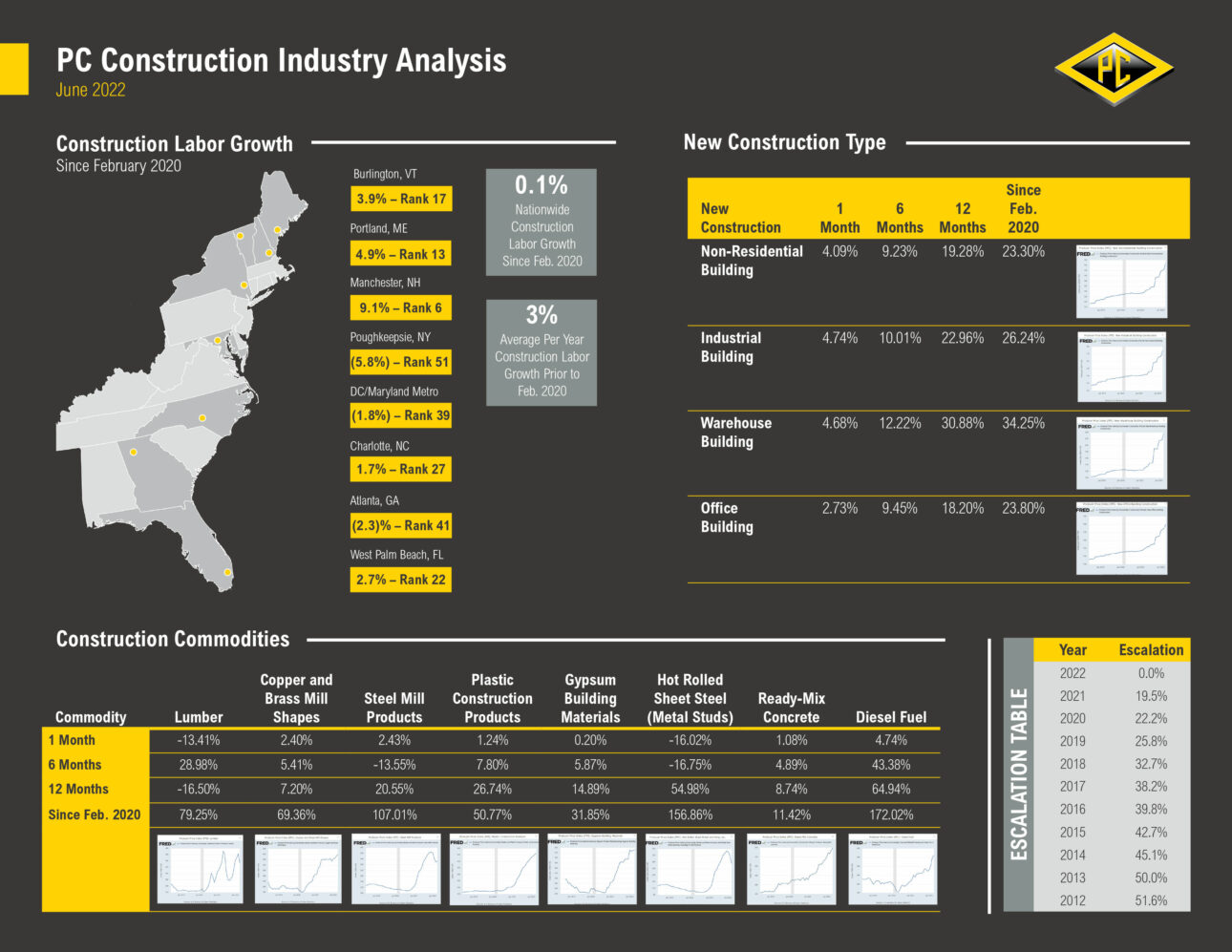

The construction industry has been on a roller coaster since 2020 due to the pandemic and fluctuating economic conditions. We have navigated dynamic material pricing increases, labor shortages and supply chain issues. PC Construction is open and transparent about these market conditions so we can understand and plan in partnership with our owner, design and construction teams. PC Construction’s Industry Analysis was developed to share these details and ensure our project partners have easy access to information that can impact project decisions.

About the PC Construction Industry Analysis

As you navigate PC’s Industry Analysis, tables and graphs tracking construction commodity pricing are shown along the bottom and pricing changes for new construction are displayed down the right side. The escalation table in the lower right corner helps owners, architects and engineers understand what a project priced or built years ago would cost today. The block in the upper left corner will feature a topic that is especially impactful at the time of distribution.

Questions?

Contact Kurt Naser, Director of Preconstruction, at knaser@pcconstruction.com.